financial life planning Purpose-built for business owners

What is life planning?

what is financial planning?

how we work

We do things a bit different than traditional financial advisors. Our process is rooted in EVOKE® Life Planning, which puts your life’s purpose front & center as the driving force for financial decision-making. We start by understanding what is most meaningful to you before we give any advice about your money. We’re confident there’s no better way to serve our clients.

get acquainted

B.O.S.S.E.S. have unique passions, we want to know yours. Our first meeting is a “virtual cup of coffee” - we’ll get to know each other, your business, and your journey. We’ll finish with a review of the EVOKE® process and get to work.

Life Planning

In our second meeting we’ll explore the various components of your most meaningful, fulfilled life. Assuming we’re a fit, we’ll use our next two meetings to prioritize what is most essential to you and build the vision of your ideal life.

financial planning

Once we know what truly matters most to you, financial planning begins. We start by solidifying your economic fundamentals, and then provide the ongoing expertise you need to live fully into your ideal life.

the tempus pecunia approach:

Focus on fundamentals & things we can control

cash flow is king

Managing cash flow is the critical building block to achieving your financial goals, both business and personal. Everything hinges on cash flow - we start there, give you tech tools to manage it, and make it the primary focus of our planning.

liquidity = war chest

Access to cash is your key to growth and survival. Liquidity takes many forms - we make sure you have a plan to access to the money you need, when you need it.

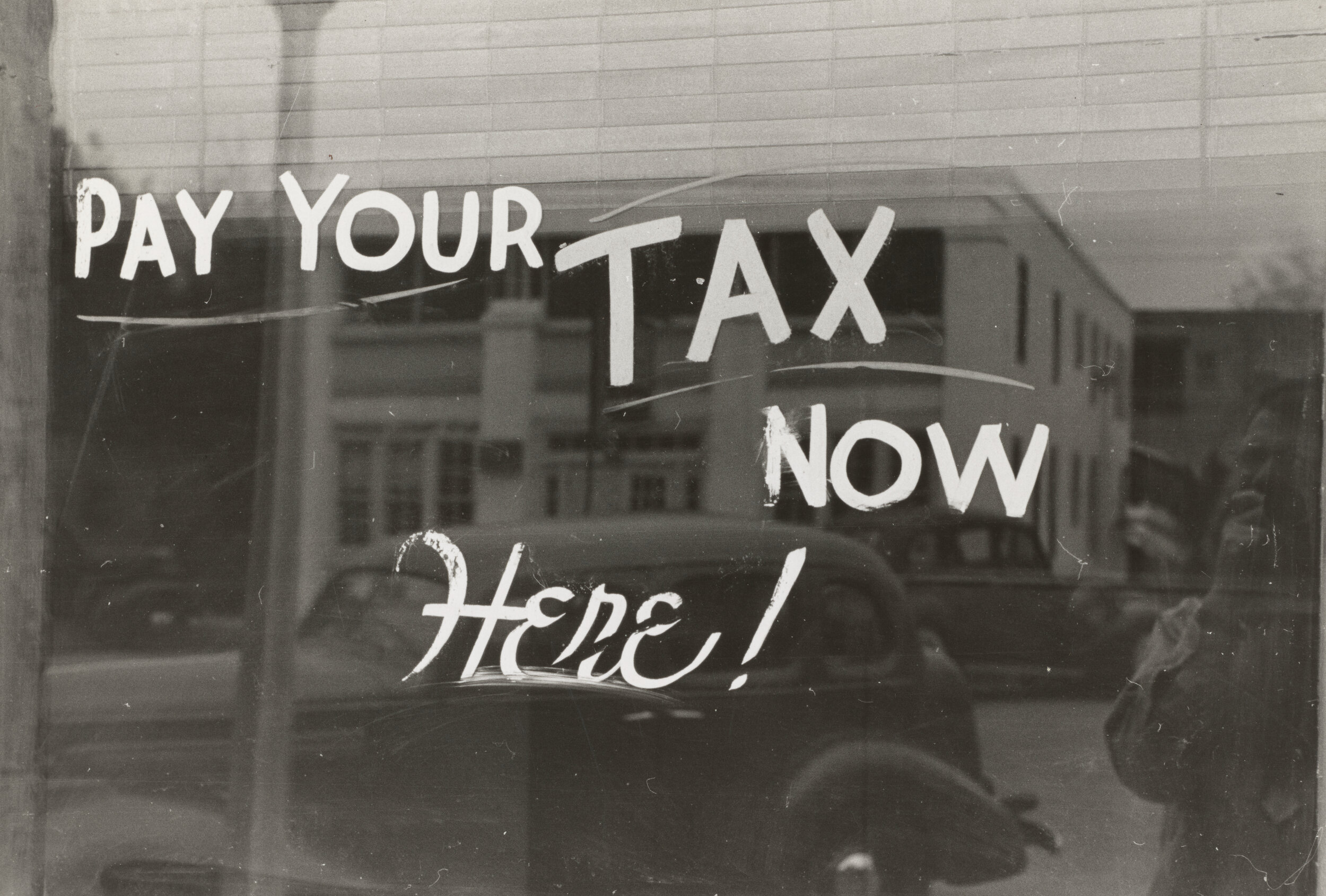

Taxes, taxes, taxes

Taxes are the biggest total expense you will pay over your lifetime. Our comprehensive approach places an emphasis on tax planning - providing tax strategies and working with your tax advisor to help you keep more of your money.

manage risk

We all have blind spots. B.O.S.S.E.S. tend to overlook critical aspects of risk management, so we make it central to our process. We identify and manage risk to protect you against the “what ifs” that could derail your business, your family, and your life.